SEPA Instant

SEPA Instant

SEPA instant is a new payment system that allows for near real-time Euro transfers across Europe. This means that when you send money using SEPA instant, the recipient receives it within seconds.

Send and receive Euro payments in under 10 seconds 24/7, 365 days a year.

To download the app today please select either link above or go directly to the App Store or Google Play Store.

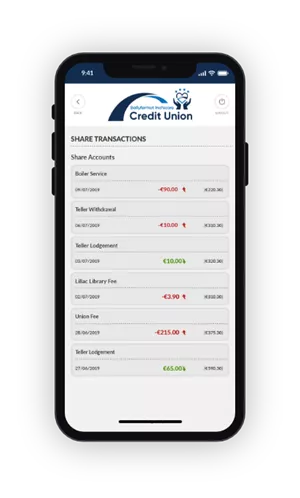

Account Transactions

Transfer funds in seconds—any time, any day.

Send and receive payments instantly, even on holidays.

Get immediate confirmation when money is sent or received.

Simplify everyday payments—from splitting bills to covering emergencies.

Our Mobile App is available to all members who have registered for Online Access. Register today and avail of all the benefits of online/mobile banking.

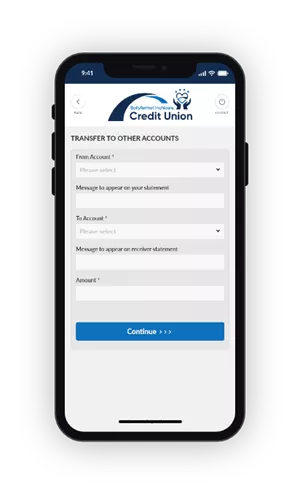

Move Funds with Ease

When you send money by EFT, our system will check if the receiving bank supports Instant Payments. If it does, your payment will be processed within seconds—no extra steps needed.

There’s nothing you need to do—Instant Payments will be enabled automatically on your account once the service is live.

Getting started with our Mobile App is easy. Firstly, please ensure you have a valid, and verified, mobile phone number. If your number is not verified, you can verify it by logging into your Online Banking Account.

Once this is completed, search for our App on the App Store or Google Play Store. Then, simply login using your Member Number, Date of Birth and Pin.

Frequently Asked Questions

While standard SEPA payments can take between one and two business days to reach the payee, SEPA Instant payments allow money to be transferred from one payment account e.g. current account to another, in euro, within 10 seconds, 24 hours a day, any day of the year, including bank holidays and weekends*.

You will also get confirmation within 10 seconds of making a payment that it has been received by the payee.

*There are a few exceptions to this. For example, times when the Credit Union’s or payment service provider’s system might be unavailable due to planned maintenance. You will be notified of any scheduled downtime in advance.

| Payment Type | Standard SEPA Payments | SEPA Instant Payments |

| Speed | 1-2 Business Days | Within 10 Seconds |

| Availability | Business Days - Hours may vary | 24 hours, 7 days a week, 365 days a year |

| Notification | Not normally provided | Real-time confirmation of receipt to payer |

The timing for offering SEPA Instant payments varies depending on the payment service provider, however all Credit Unions, banks and payment service providers within EU countries who use the euro must:

- From January 2025: be able to receive SEPA Instant payments

- From October 2025: be able to send SEPA Instant payments

Payment service providers in the EU/EEA whose currency is not euro have until January 2027 to be able to receive and July 2027 to be able to send SEPA Instant payments.

Non-EU/EEA countries within SEPA such as the UK and Switzerland are not required but may choose to adopt SEPA Instant payments voluntarily (Link to EPC Geographical scope here)

Fees for sending and receiving SEPA Instant payments are the same as you currently pay for standard SEPA payments.

Registration is not required. The ability to send and receive individual SEPA Instant payments is available automatically through your usual channels, including mobile apps, online banking, and branch services.

If you are making a transfer from one payment account to another, SEPA Instant offers real-time payment processing making money available to the recipient almost immediately, which may be helpful for urgent or time-sensitive transactions. You will also get confirmation within 10 seconds of making a payment that it has been received by the payee. There are no additional fees for making SEPA Instant payments; fees are the same as for standard SEPA payments.

SEPA Instant payments will be available on your existing payment channels, such as digital (e.g. mobile and online banking) and at the Credit Union.

SEPA Instant payments can be made from payment accounts such as current accounts and some deposit accounts.

Yes. You can set limits for SEPA Instant payments within the overall payment limits of your Credit Union, bank or payment service provider.

You can reach out to a member of our team at the Credit Union. Make sure to check our website for the most up-to-date contact details and service hours.